Renters Insurance in and around Ridgecrest

Welcome, home & apartment renters of Ridgecrest!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Ridgecrest

- Inyokern

- Lake Isabella

Home Is Where Your Heart Is

Your rented space is home. Since that is where you kick your feet up and relax, it can be a good idea to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your lamps, coffee maker, microwave, etc., choosing the right coverage can make sure your stuff has protection.

Welcome, home & apartment renters of Ridgecrest!

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented apartment include a wide variety of things like your microwave, set of favorite books, exercise equipment, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent Gary Charlon has the dedication and experience needed to help you choose the right policy and help you protect your belongings.

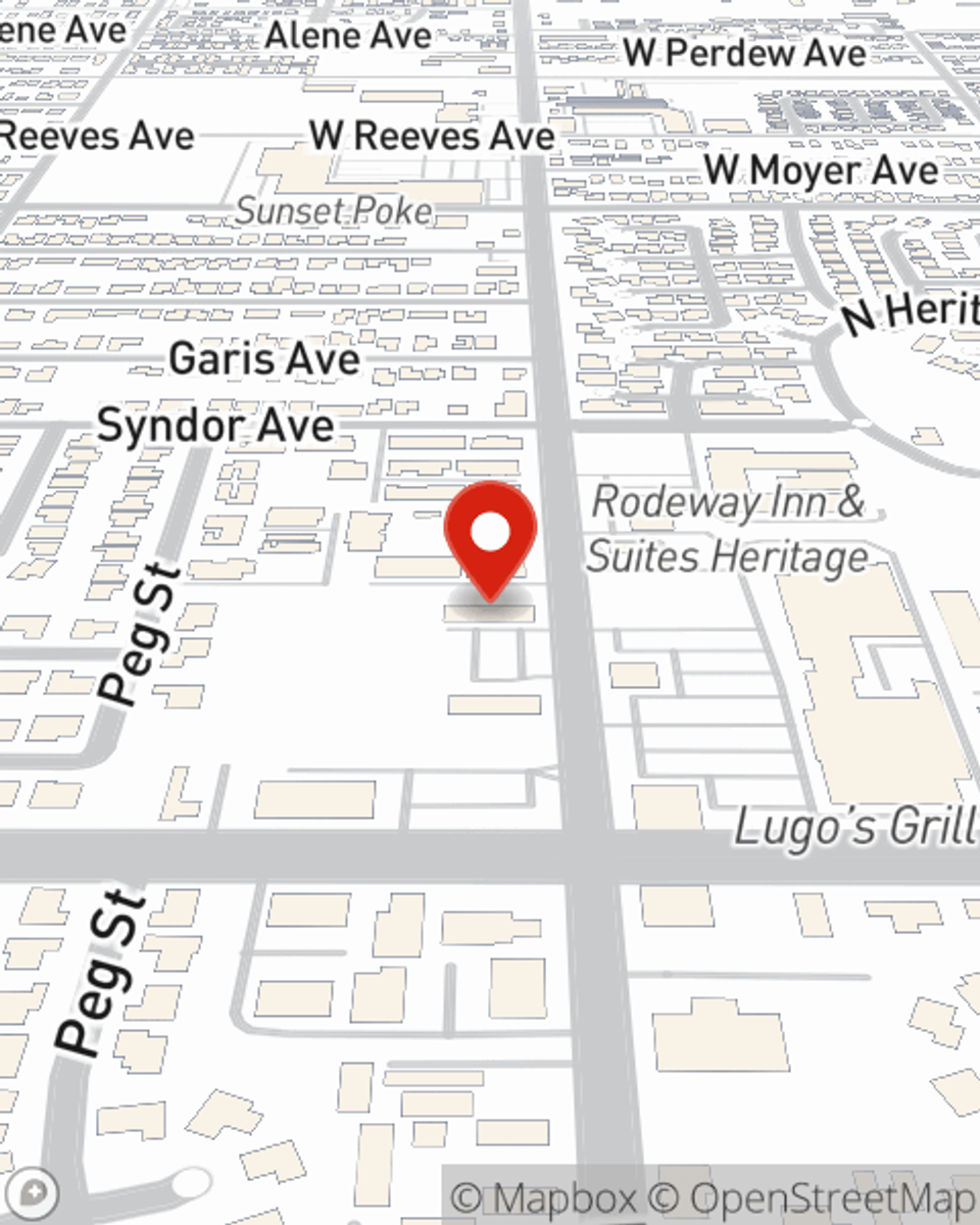

Renters of Ridgecrest, reach out to Gary Charlon's office to explore your individual options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Gary at (760) 446-4279 or visit our FAQ page.

Simple Insights®

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Gary Charlon

State Farm® Insurance AgentSimple Insights®

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.